Multi-use bill payment apps like the myAirtel app have fast gained popularity owing to their versatile, one-stop nature. If you don’t use these apps, you’re really missing out.

Paying bills is a monthly chore that you just cannot get out of. Working on the principle of, ‘If you can’t beat them, join them’ it’s time you stopped thinking of bill payment and recharges as a regular headache, but as an activity that you can complete in mere minutes.

How? By using multi-utility bill payment apps. Here’s why:

* A single stop for all payments and recharges.

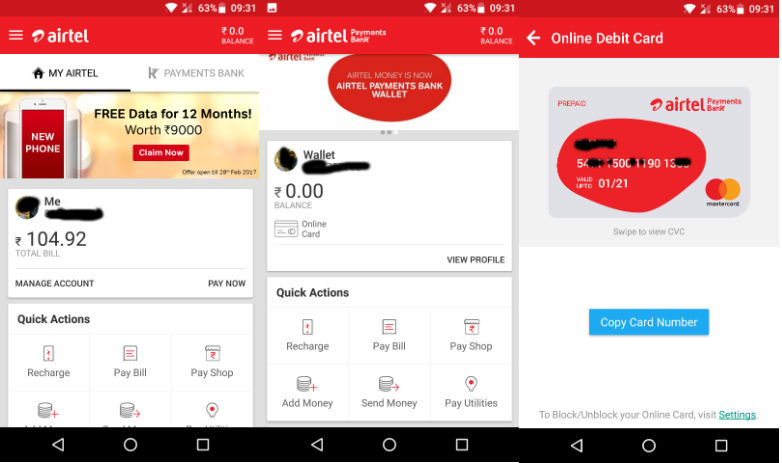

A multi-use bill payment app like myAirtel ensures that you don’t need different apps for different payments. Just download the myAirtel app and do a variety of things – recharge your DTH and prepaid phone connection, pay postpaid and broadband bills, pay utility bills, transfer and receive money, etc. The myAirtel app replaces at least five other payment apps that you would otherwise have on your phone. Too many apps running in the background can slow down your phone and consume a lot of battery. Instead, just one app that does it all is better for your phone’s overall functioning.

* Convenient.

Apart from offering the ease of transferring money and paying a multitude of bills, multi-use bill payment apps offer unparalleled convenience. Well designed ones like the myAirtel app often store your payment and bill history, as also your bill payment dates. So, you are reminded in time about recharges and payments. Meanwhile, the myAirtel app does not restrict payments to Airtel numbers alone – any mobile, broadband and DTH service provider, as well as utility provider payments, can be made via this app. Thus, it is extremely convenient for all your bills and recharges.

* Cost-effective.

You might be using your bank’s app or net banking services to transfer payments for your bills and other utilities. However, this costs money that you don’t initially realise – banks charge transaction fees to online merchants, who then transfer the same to the customer. The merchant often ties in the transaction cost into the final payment – which is not immediately apparent to you. Thus, you end up paying more. But this does not happen with bill payment apps.

* Money saving.

Far from charging you for using the app to make payments, bill payment apps like myAirtel offer cashback and discounts on recharging and bill payment. You can avail of the cashback at the time of recharging your DTH or prepaid connection. So you end up saving not just time and effort, but also money when you use these apps.

More reasons to use the myAirtel app…

* It has the Airtel Payments Bank. Apart from facilitating bill payments, the myAirtel app also houses the superb Airtel Payments Bank. This is India’s first mobile-powered money transfer and bill payment app which also serves as a savings bank account that offers a high interest rate of 7.25% on the money lying idle in the account. Even mainstream banks do not offer this much interest on savings deposits at the moment.

* Watch your favourite movies and TV shows. The time you spend commuting to and from work, or travelling to another city, or in between two tasks, is like a state of limbo. You can’t do anything productive in this time, so it is better spent in recreation. And what better way to do this than by watching your favourite TV shows and movies? You can get access to premium TV and film content via this app, apart from live sports.

* Play music and games.When going for a jog in the morning or cleaning out your desk, your favourite music keeps you company. Get access to all the latest tracks, or your favourite 60s and 70s Bollywood tunes, or new hip hop and pop music, using the myAirtel app. You can also indulge your love for online gaming with the app.

* Back your data.Your biggest worry about your smartphone is that it will get misplaced or damaged, and you will lose all your data. But did you know that the myAirtel app backs up your phone and SIM data constantly, and links it with your mobile phone? So whether you lose your phone, or your SIM gets corrupted, or your handset is damaged, your data is still secured and accessible as long as you have the same phone number.